As early as 2015, the EU presented an action plan for a circular economy with the goal of "closing the loop." The vision behind it was to endlessly recycle raw materials and thus avert the climate and environmental crisis. Even eight years later, and although there are some successes to report, we still face many challenges in achieving this goal.

Current Challenges and Desired Goals

The current state of the plastic circular economy in Europe is still far from the set goals despite the EU's efforts. Each European produces an average of three kilograms of plastic waste per month. In 2020 alone, according to the OECD, 450 million tons of plastic were produced worldwide. This amount could triple by 2060. Although the EU records "recycling records," only about 40% of old plastic in Europe is actually recycled. The rest is incinerated or ends up in waters and soils. Recent research by Investigate Europe shows that there is still a strong imbalance within the EU. Some European countries still primarily rely on disposal and do little recycling.

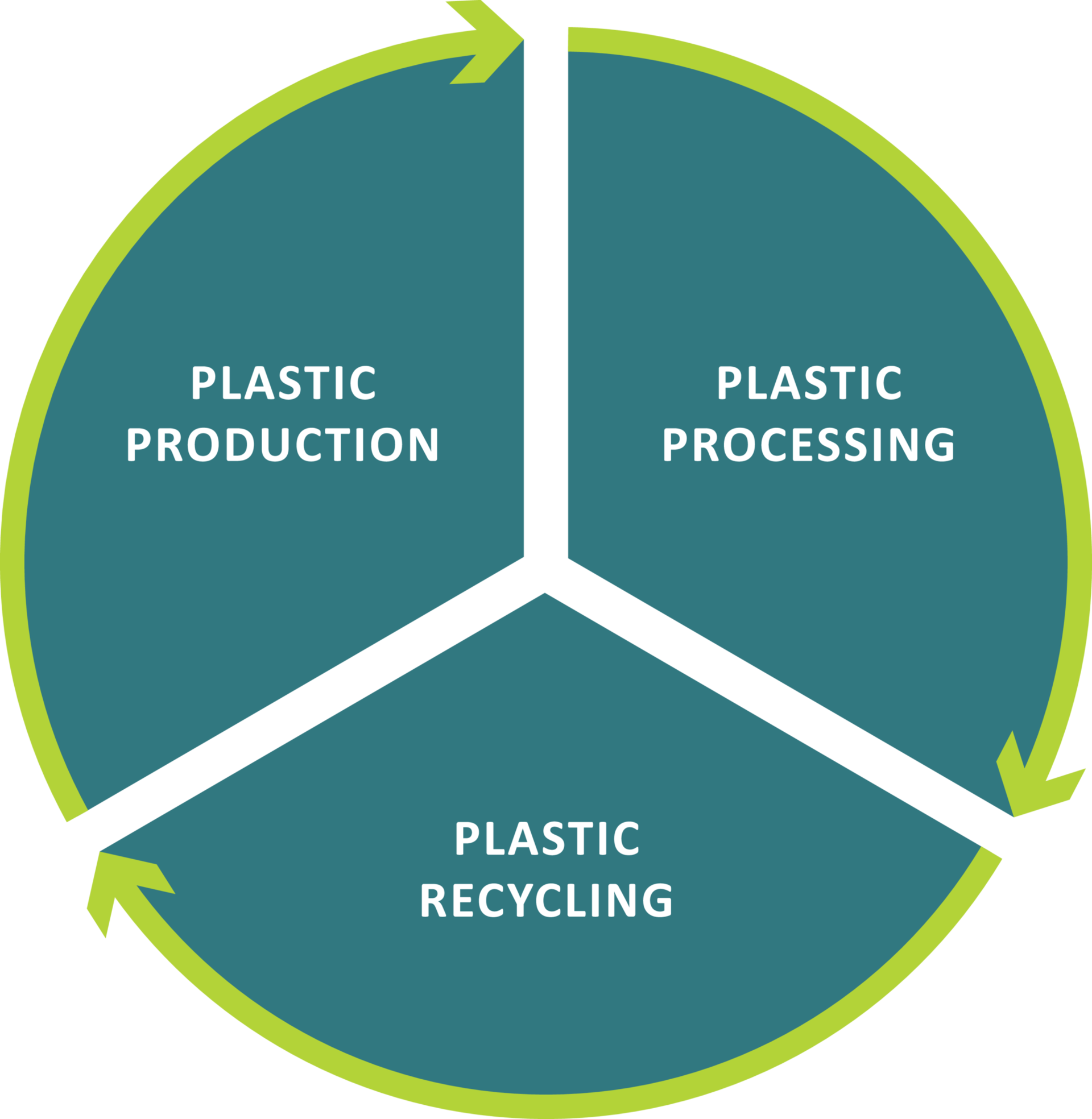

To create a functioning system without financial losses, plastic waste, or pollution, a systemic approach is required: a complete redesign of the production, use, and reuse of plastics and a restructuring of the underlying system. The Ellen MacArthur Foundation, a non-profit organization dedicated to creating a circular economy, has outlined six core points that encompass the vision of a circular economy for plastics:

- A top priority is the elimination of problematic and unnecessary packaging through redesign, innovation, and new delivery models.

- In addition, single-use packaging should be reduced through reuse models.

- All plastic packaging should not only be 100% reusable, recyclable, or compostable, …

- but also actually reused, recycled, or composted.

- Furthermore, a clear separation between the use of plastics and the consumption of finite resources is necessary.

- All plastic packaging should also be free of hazardous chemicals.

However, to realize this vision of a circular economy for plastics, it is not only necessary to eliminate all problematic and unnecessary plastic items but also to have technological innovations to ensure that the plastics we need are reusable, recyclable, or compostable.

Possibilities for optimizing the recycling rate and the use of recyclates.

A frequently discussed solution for the improvement of plastic recycling is a statutory minimum quota that prescribes what proportion of plastic waste must be recycled. This would lead to more sorting and thus a higher availability of recycled material. Another measure would be a statutory minimum quota for the use of recyclate in certain plastic products. Currently, there are only recycling quotas for PET single-use bottles in the EU and Germany. From 2025, these must consist of at least 25% recycled material, and from 2030, 30%. Germany has already surpassed this hurdle and takes a leading role in Europe with a 40% recyclate content in PET bottles. In November 2022, the European Commission also proposed a binding quota for recycled material in all new plastic packaging.

Expanding deposit systems to other product groups could also increase the recycling rate. Deposit systems make it possible to separate plastic waste cleanly and produce high-quality recyclate.

However, to achieve the EU's goals on the path to a circular economy, more than just quotas are required. From the outset, every package must be designed intelligently for recycling according to strict guidelines. Furthermore, high recycling rates must be implemented not only in Germany but throughout the EU to obtain sufficient recyclate for food packaging. Additionally, new recycling technologies should be approved more quickly for the food sector.

Previous Successes

Although there is still a long way to go, efforts to promote the recycling of plastic packaging are already bearing fruit. In 2021, a material recycling rate of 65.5% was achieved in Germany, which represents an increase of 5% compared to the previous year.

This even exceeded the increased recycling target of 63%, which has been in effect since 2022. Since the introduction of the Packaging Act in 2019, the recycling rate has increased by 55%.

The design-for-recycling approach is also showing initial success. According to a study by GVM (Society for Packaging Market Research), 74% of household-collected plastic packaging is well recyclable. In 2016, it was 66%. To maintain this trend, the German government, for example, is taking another step forward with the expansion of the Packaging Act. Since the beginning of 2022, all single-use plastic beverage bottles and all beverage cans are subject to a deposit. To counteract the daily tons of packaging waste generated by take-away single-use packaging, catering establishments must also offer reusable containers for take-away food and drinks from this year onwards. Various systems have already been established for reusable coffee-to-go cups. Due to the EU-wide export ban on hard-to-recycle plastic waste, waste exports to China and Southeast Asia have also decreased significantly since 2016.

According to a study by GVM and the Ifeu Institute for Energy and Environmental Research Heidelberg titled "The Contribution of Circular Packaging to the Climate Neutrality Goal 2045," greenhouse gas emissions resulting from raw material production, packaging production, distribution, as well as disposal and recycling, could be reduced by 94% by 2045. According to the study, packaging consumption in Germany reached its peak in 2021 and will continuously decrease in the future. At the same time, the use of recyclate will increase.

Tense situation in the plastics industry

Problems of Plastic Processors

Weak demand, high energy costs, and a shortage of skilled workers are currently (May 2023) causing concerns for plastic processors. Almost one in five companies has significantly reduced its production. The outlook for the coming months is also bleak, as more than a third of companies expect a reduction in the workforce in the industry. According to the IK (Industrievereinigung Kunststoffverpackungen e.V.), the main reason for the current crisis is the weak demand for plastic packaging. The falling raw material prices since March have had a negative impact on the entire plastic circular economy. Plastic processors face the problem, for example, that they would have to buy expensive recycled material to meet quotas. However, this affects profitability.

Problems of Plastic Recyclers

Due to the ongoing price competition, plastic processors often opt for the cheapest offer and increasingly use virgin material, which in turn puts plastic recyclers under pressure, as explained by the plastics recycling association at bvse. The demand for recycled plastics is so low that production sometimes has to be restricted or even shut down. The inventory of regranulates, regrinds, and compounds is also steadily growing. Due to weak demand, the buyer markets are taking up too little secondary material. The situation is particularly precarious in the area of PET recycling.

Conclusion

Overall, the plastic circular economy in Europe is still far from the set goals despite the EU's efforts. The recycling rate is only about 40%, while the production of plastics continues to increase. Fundamental changes are needed in the manufacturing, use, and reuse process of plastics to achieve sustainable and environmentally friendly use. Legal minimum quotas for recycling and the use of recyclates, as well as the expansion of deposit systems, can be helpful measures. Despite some progress, the challenge remains to create a functioning system without financial losses, plastic waste, or pollution.

A systemic approach and the increased use of innovative sorting technologies and solutions are required to ensure the competitiveness and at the same time the profitability of recyclers. This is a prerequisite for improving the recycling rate, promoting the use of recyclates, and realizing the long-term goal of a circular economy for plastics.